16 Jun Opportunity Zone Legislation in Puerto Rico

The 2017 Tax Cuts and Jobs Act (the “TCJA”) incorporated in the United States Internal Revenue Code of 1986, as amended (the “IRC”) the concept of Opportunity Zones (the “OP Zones”). If a person realizes a capital gain and invests it in a duly designated OP Zone and complies with various requirements set forth in the IRC, some tax benefits can be obtained for federal tax purposes. The OP Zone designation is reserved to certain economically distressed communities and it includes locations in the 50 states and the possessions. Note that due to our economic condition more than 95% of Puerto Rico has been designated as an OP Zone.

Since Puerto Rico has its own tax regime it was necessary to adopt local legislation providing similar benefit in the Puerto Rico Internal Revenue Code of 2011, as amended (the “PRCode”) to ensure that US investors that took advantage of these provisions at the federal level were not subject to Puerto Rico taxation. Furthermore, a local statute would allow Puerto Rico residents to take advantage of this initiative. Act 21 of 2019 (“Act 21”) was approved last month and incorporated in the PRCode similar provisions to the ones set forth in the TCJA. Moreover, Act 21 provides some additional benefits to improve the offer over what other states were offering.

General Exemption

The OP Zone provisions provide for three main benefits.

- Any capital gain realized after December 31, 2017 (the “Original Capital Gain”) which within 180 days is reinvested in an OP Zone is deferred and does not have to be recognized until the year 2026. If the investment within the OP Zone is disposed of prior to 2026, then the gain is recognized in such period.

- The Original Capital Gain can be reduced based upon the holding period. If the investment in the OP Zone is maintained for five (5) years, the Original Capital Gain is reduced by 10%. Furthermore, if the investment in the OP Zone is maintained for seven (7) years, the original capital gain is reduced by an additional 5% for a total reduction of 15% of the original gain. Pursuant to the statue a mandatory recognition is required by December 31, 2026. Therefore, in order to comply with the seven (7) year rule by December 31, 2026, the investment must be made no later than December 31, 2019. The reduction in gain is achieved by increasing the tax basis of the taxpayer in the Original Capital Gain.

- If the investment in the OP Zone is held for ten (10) years or more, any realized gain related to the investment in the OP Zone (the “New Capital Gain”) is totally exempt. Note that the exemption in the New Capital Gain is potentially the biggest attraction of this legislation. Obviously to get this benefit the economically depressed area must make a turnaround, making the investment one that generates a substantial gain.

Pursuant to Act 21, Section 1031.06 is added to the PRCode to provide for the aforementioned benefits. Note that only the general requirements are applicable.

Additional Benefits

A committee created pursuant to Act 21 will determine which are the OP Zone Priority Projects. Activities carried out in such areas would be deemed eligible activities to obtain the tax benefits discussed below. Note that an incentives grant must be obtained to receive these additional benefits. For a project to be considered an eligible business and obtain the incentive grant, it must meet the following requirements:

- The activity must be held in an eligible area. This is an area in Puerto Rico that has been designated as an opportunity zone.

- The activity carried out by the business is not eligible for a tax exemption concession under the following incentives:

- Act 20-2012 (Export Services Act)

- Act 73-2008 (Economic Incentives Act for the Development of Puerto Rico)

- Act 74-2010 (Tourism Development Act)

- Act 83-2010 (Green Energy Incentives Act)

- Act 27-2011 (Puerto Rico Film Industry Economic Incentives Act)

- The activity is carried out by a Qualified Opportunity Fund or an asset that invests in the Fund and 50% or more of the capital contributed comes from an investment.

- The activity carried out by the business is a Priority Project in the opportunity zone. This is an industry or business or any other activity to produce income that will contribute to the economic recovery of the eligible area.

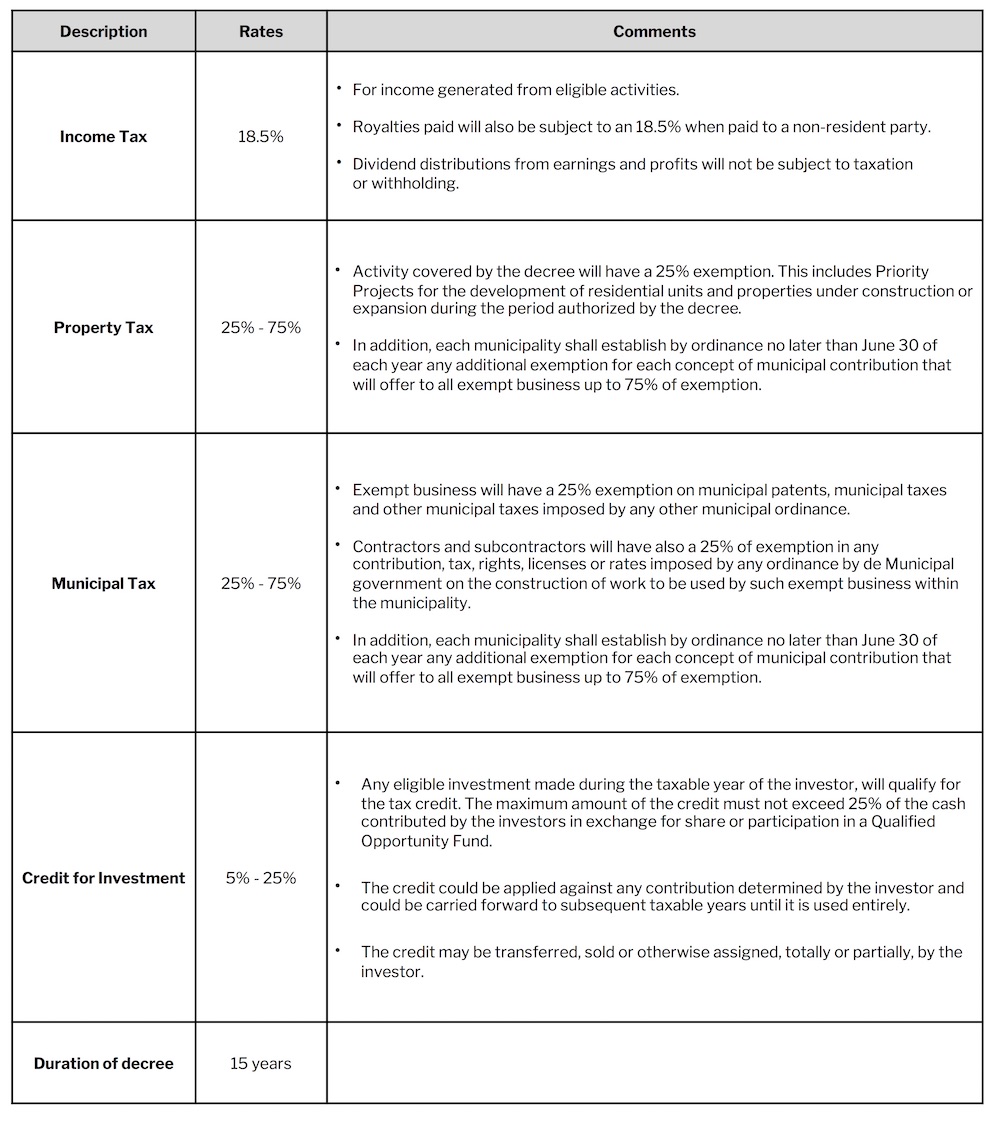

Tax Benefits

Please note that this is a very technical provision. Accordingly, we strongly suggest you obtain additional advice if you plan to invest in this alternative.